Corporate tax management

Arsene makes its expertise available to clients through daily tax management assistance. Arsene helps internal teams with year-end balance sheets and tax filings, with specific tax and customs systems, with tax and customs treatment of flow of goods and legal flows, URSSAF issues, etc.

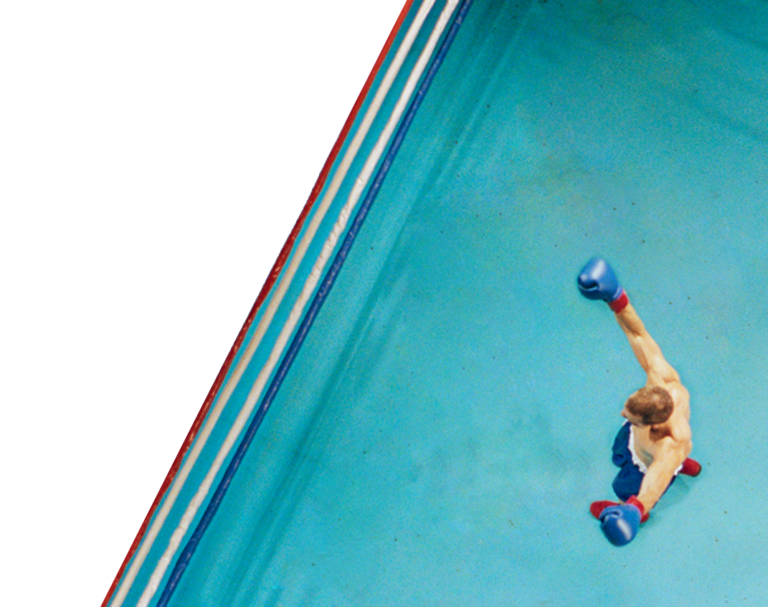

Arsene can assists a company in every aspect of its evolution, bringing its time-tested tax expertise to the table to support internal teams and their financial and legal counsel during exceptional transactions including legal restructuring, acquisitions or sales, refinancing, and operational reorganisation leading to new transfer price policies.

Arsene ensures that national and international information and compliance regulations are respected and assists corporations in designing and implementing internal procedures for filing requirements. Arsene and Taxand especially advise and assist corporations in drawing up transfer price documents and Country by country Reporting.

Arsene helps companies with their digital tax management including: preliminary audit and support with ERP implementation of migration, advice on implementing tax archiving and e-invoicing (EDI, signed invoices, robust audit trail), IT system data analysis, and implementation of a robust audit trail.